Market Background

United States is the largest market for vegetable oils, accounted for approximately 80% of volumetric share in North American vegetable oils market in 2019. US dominates the oils and fats regional market, owing to its high consumption and export of oils.

The future of US vegetable oils industry is projected to be optimistic as there is growing usage in food applications. The demand for vegetable oils, such as soy oil, canola oil, and palm oil from bakery, foodservice, and the food processing sector are expected to proliferate the growth of vegetable oils in the upcoming years. Furthermore, increasing utilization of vegetable oils such as palm oil in non-food uses is projected to aid the market growth.

Palm Oil in US

Over the past decade, consumption of edible oils and fats, including palm oil, has undergone considerable change in US. Several factors, including consumer awareness of nutrition and health attributes of various oils and fats, dietary guidelines, and legislation in the form of nutrition labeling of saturated and trans fats helped shape the consumption patterns in US.

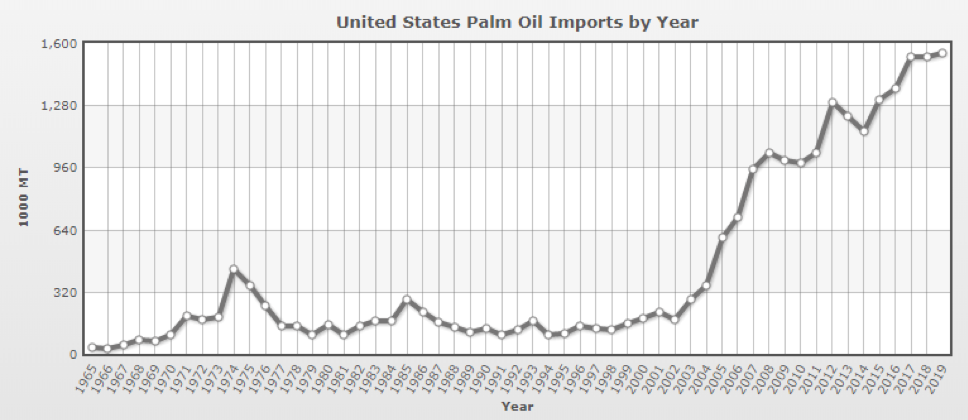

According to the earliest recorded data published by the research group IndexMundi, palm oil has gained access into the US market since 1965. Import volumes have grown steadily over the years and recorded a huge leap in imports between 2002 and 2008. In 2019, US palm oil import reached 1.58 million MT.

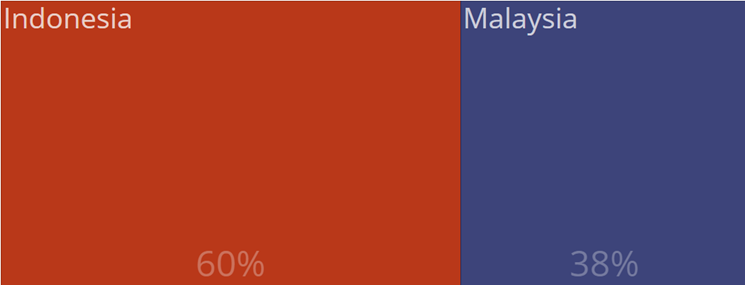

Data released by the US Census Bureau showed that US palm oil imports from Jan-Dec 2018 amounted to $1.09 billion compared to $1.05 billion in 2017. Top three palm oil exporters were Indonesia, Malaysia, and Colombia. Palm oil imports from Malaysia constitute 38% of the total imports in 2019.

U.S. palm oil imports market share, Jan-Nov 2019 (Total 1.43 Mn T)

Note: This data is based on shipments arrival in the U.S. from Jan-Nov 2019 and may differ with the data published by MPOB for exports to the U.S. from Jan-Nov 2019

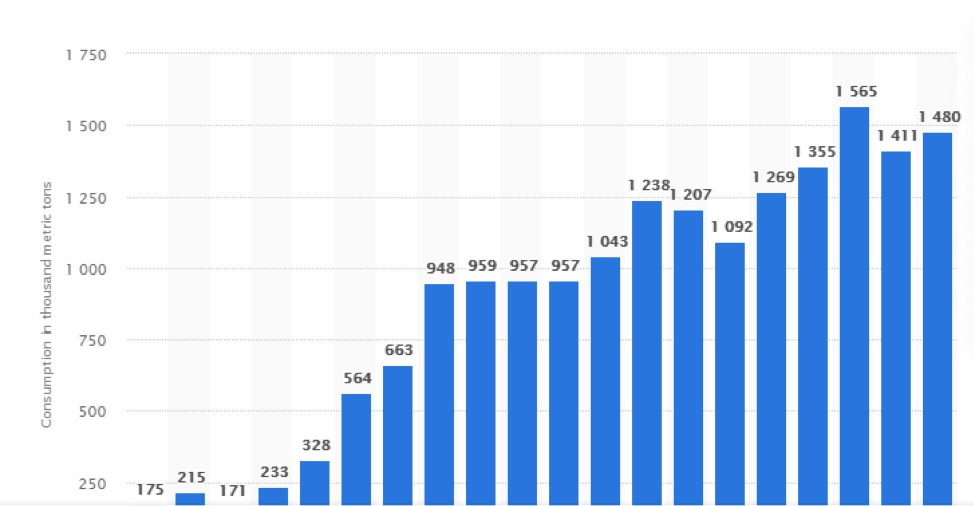

Based on the data published by Statista, US consumption of palm oil were recorded at 1.48 million MT in 2019. Competitive palm oil prices in recent months and the functional applications of palm oil in the food sectors are two of the key factors in sustaining palm oil demand and consumption growth in the US.

Palm oil consumption in the United States from 2000 to 2019 (in 1,000 metric tons)

Logistical Supports and Opportunities for Palm Oil

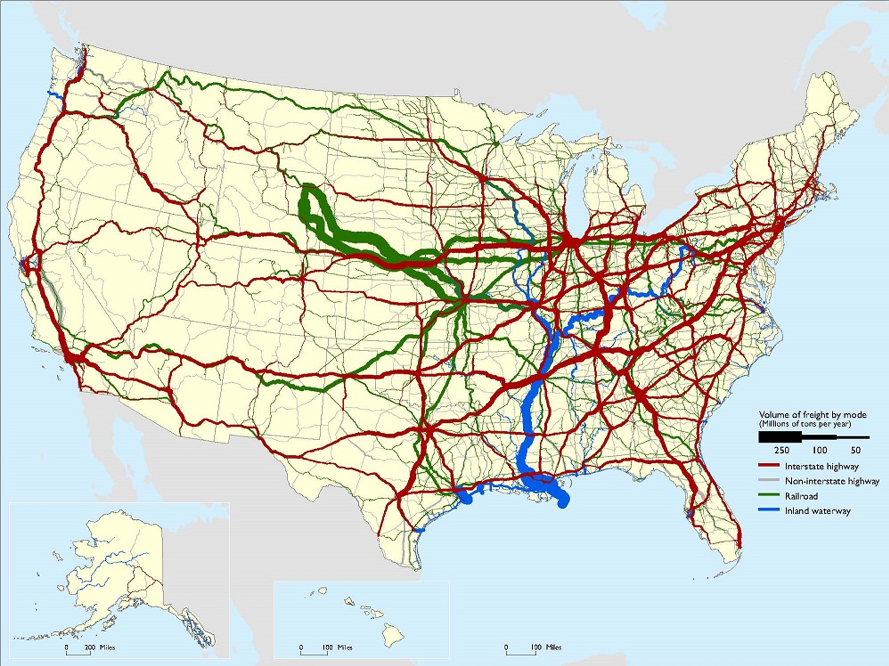

Edible oils market in US food sector is a huge 11 million tonnes industry due to its large number of food related businesses. Market sectors of bakery, snack food and dairy products constituted huge growth and demand potential for palm oil. The East Coast is the most populous region in the US which support huge demand and consumption for oils and fats, including palm oil. High concentration of highway, railroad and waterway systems within the East Coast makes this area suitable for oils and fats distribution network centers, making it the primary destinations for palm oil imports.

Freight Flows by Highway, Railroad, and Waterway in US

About 80% of all palm oil imports landed on the East Coast. Agricultural commodity uses the ocean transportation network extensively to serve its global customers. The WorldCity research group reported that in 2019, the top three ports of entry for palm oil were the Port of New Orleans in Louisiana, Port of Savannah in Georgia and Port of New York in New York. These ports have the facilities to handle palm oil shipments.

Top 10 Port of Arrival for Palm Oil Import (2019)

| No | US Arrival Port | Palm Oil Arrival (%) |

|---|---|---|

| 1 | New Orleans | 35.7 |

| 2 | Savannah | 30.6 |

| 3 | New York | 14.3 |

| 4 | Stockton | 6.7 |

| 5 | Richmond | 5.6 |

| 6 | Charleston | 3.9 |

| 7 | Houston | 1.5 |

| 8 | Long Beach | 0.5 |

| 9 | Los Angeles | 0.4 |

| 10 | Boston | 0.3 |

Source : Datamyne.com

The New Orleans Port brings all modes of transportation (ocean, barge, rail, and truck) together by giving ocean-going vessels access to ports 228 miles upriver from the Gulf of Mexico, linking them with the Gulf of Mexico, Caribbean Sea, Atlantic Ocean, and Panama Canal. New Orleans is also an important port region for US agricultural imports of bulk commodities like coffee and edible oils such as palm oil and coconut oil. Because of its strategic location, agricultural imports that transit through New Orleans come from all over the world. Some of the top origin countries were Canada, Malaysia, Indonesia, Brazil and Mexico. The top three ocean carriers which moved about 46% of agricultural imports through New Orleans, were Cargill, Great White Fleet, and Raffles Shipping & Investment.

Top U.S. Waterborne Agricultural Imports through the New Orleans Port Region

| No | Commodities | Total Import (%) |

|---|---|---|

| 1 | Palm Oil | 22% |

| 2 | Coffee | 14% |

| 3 | Bananas | 13% |

| 4 | Palm Kernel Oil | 11% |

| 5 | Coconut Oil | 8% |

Source: Port Import Export Reporting Service (PIERS)

Top Shipping Lines Used to Move US Waterborne Agricultural Imports Through New Orleans Port Region

| No | Shipping Lines | Total Arrival (%) |

|---|---|---|

| 1 | Cargill International | 21% |

| 2 | Great White Fleet | 14% |

| 3 | Raffles Shipping | 11% |

| 4 | Mediterranean Shipping | 8% |

| 5 | Hapag Lloyd Line | 6% |

Source: Port Import Export Reporting Service (PIERS)

The second largest port of entry for palm oil; Port of Savannah, is located on the U.S. Eastern Seaboard just up the Savannah River from the Atlantic Ocean. It is operated by the Georgia Ports Authority. The Port of Savannah is the 4th largest container port in the United States, handling more than 2.9 million 20-foot-equivalent units of containers annually. The port imported more than two million MT of agricultural products every year where top agricultural imports are sugar, palm oil and beer. The port imported 27% of U.S. waterborne imports of palm oil and 34% percent of palm kernel oil (2011). The top origin markets were Panama, Malaysia, and Brazil while top shipping lines are Navesco SA, Maersk, and Cargill International.

Top Shipping Lines Used to Move US Waterborne Agricultural Imports Through Port Savannah

| No | Shipping Lines | Total Arrival (%) |

|---|---|---|

| 1 | Navesco | 30% |

| 2 | Maersk | 6% |

| 3 | Cargill International | 5% |

| 4 | Hapag Lloyd Line | 5% |

| 5 | Mediterranean Shipping | 5% |

Source: Port Import Export Reporting Service (PIERS)

Expanding Malaysian palm oil market in the food sector within the East Coast with main focus on the usage of palm oil in bakery, snack food and dairy products is a progressive way forward. These three market sectors constitute huge growth and demand potentials for palm oil. There are opportunities for Malaysian companies to establish palm oil handling and redistribution centers at the US ports. This could pave the way for the market expansion of Malaysian palm oil within the East Coast of US.

Prepared by Zainuddin Hassan and Nur Adibah

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.